Return on Equity (Return on Net worth)

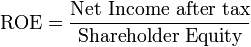

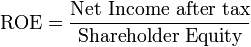

Return on Equity (

ROE), also called as Return on Net Worth, is one of the key

financial ratios which indicates how well the management has been efficient in managing the company's assets. In my early days in the investing world, this is the ratio which confused me the most. Return on Equity is defined by the following formula

What is confusing in the above formula for beginners is the meaning of '

Shareholder's equity'. Shareholder's equity should not be confused with 'total value of all the equities, i.e. shares'. The later is called market capitalization of the company. Shareholder's equity is defined by

Shareholder's equity = Total Assets - Total Liability

In other words, Shareholder's equity is nothing but the amount of money that the company would be worth if it were to go bankrupt at this very moment. This is also called as book value.

How to calculate ROE?

In order to calculate ROE, Return on Equity, lookup any financial portal or the company's annual report for the following

- EPS - the earning per share of the company.

- Book Value - The book value of the company per share (i.e. shareholder's equity divided by the number of shares).

Then to calculate

ROE you simply divide EPS by Book Value. ROE is typically expressed as a percentage (i.e. multiply by 100 and put a "%" sign).

Example of Return on Equity : Let us say a company earns Rs. 100 per share and the book value of the company is Rs. 300. Then the Return on equity is 33.3%.

Typical values of Return on Equity and what it means

As a general rule of thumb, you should be careful while investing in any company whose ROE is less than 10%. I personally prefer stocks which give a return on equity of at least 20% or more. Obviously return on equity is a direct measure of how well the company is generating cash with the amount of 'shareholder's money' it has. There is one more thing which ROE tells you and which most financial websites don't mention. ROE also tells you how easy it is for the company to profitably expand its business. For example, let us take a situation where the company does not have any debt. Then an ROE of 25% means that the company is producing Rs. 25 for every Rs. 100 of assets it has. Thus if the company were to expand its business, then for every Rs. 100 spent on expansion, it would earn Rs. 25, which is greater than the usual interest rates. If ROE is roughly the same as the bank interest rates, then it means that even if the company expands, it will take a long time for it to make its investments in expansion profitable.

Variations: Return on Average Equity

The Book Value of a company can significantly change during a given year. In these circumstances, one can calculate the average book value (average of the book value in the beginning of the year and at the end of the year) and use it to calculate ROE.

What ROE does not tell you

ROE, like any other financial ratio is very far from being perfect. For example, ROE does not tell you anything about the debt of the company. As explained before it does say something about the potential of the company to expand its business, but does not actually tell you anything about the possible or expected growth of the company. Nevertheless, ROE is a very basic ratio, and used in addition with few other indicators like topline growth and financial ratios like P/E, Debt/Equity and

profit margins can give a reasonable good and quick overview of the company.

ROE versus ROCE

A related ratio to Return on Equity is

Return on Capital Employed (ROCE) or also called by the name of Return on Capital Invested (ROCI). ROCE is defined to be

Operating Profit means profit before tax, depreciation, interest and exceptional items. While Capital Employed is the cash (& assets) that was actually used to do the business in that year. The formula for calculating Capital Employed is

Note that Current Liabilities are those liabilities which the company has to meet immediately (in the coming year). ROCE can sometimes give a slightly accurate picture than ROE, but I have found that overall if you look at the values of ROE for the past 5 years, you get roughly the same picture of the company as you would get by looking at values of ROCE. Moreover, ROE is easier to calculate.