Wind Energy

I am bullish on Wind Energy - and other green energies like those from Biofuels. There are several reasons for this and some of them are discussed in my earlier post on Investing in Wind Energy Stocks. No doubt, other forms of energies like Nuclear energy will also play an increasing role. However, there are strong reasons why I think that we will soon see a period where there will be a 'boom' in wind energy, with several companies trying to set up their own wind farms and wind turbines to satisfy their energy requirements. In this post I am going to analyze a Wind Turbine manufacturing company 'Suzlon Wind Power' (together with Repower, its subsidiary) and explain why at current valuations, this company offers the best investment opportunity, with a time frame of 3 to 5 years. Even if you are not located in India, you can buy stocks of Indian companies, for e.g. by registering with Interactive Brokers. Suzlon Wind Energy and Repower- best Wind Energy Stock

Suzlon owns 90% of the Repower, and Suzlon Repower combine are the third largest wind turbine manufacturers by market share. Suzlon acquired Repower in 2009, by aggressively outbidding Areva. Read more about Suzlon acquires Repower. Here is the general business overview of Suzlon and Repower.- Suzlon manufactures wind turbines in the range of upto 2.1 MW capacity and targets developing and emerging economies like India, China, Latin America, etc. In 2009, Suzlon held a market share of 53% in India. See Suzlon Products Portfolio on Suzlon's homepage.

- Repower manufactures turbines in from 2.5 MW to 6.15 MW capacity and mainly targets developed nations like Europe, UK, US, etc. Repower 6.15 MW turbines are highly suitable for offshore wind farms, something we will see more in the coming years - as building large wind farms in the sea becomes more economically viable option than using up the expensive land area. See Repower products Portfolio on Repower's homepage.

Although the above is only a rough guideline, note that Suzlon also has sold several wind turbines in developed world e.g. U.S., Australia, etc. To dig deeper into Suzlon's business model, i recommend reading Suzlon's Investor Presentation.

Although the above is only a rough guideline, note that Suzlon also has sold several wind turbines in developed world e.g. U.S., Australia, etc. To dig deeper into Suzlon's business model, i recommend reading Suzlon's Investor Presentation.Note on REPOWER wind energy stock : Note that REPOWER stock can be bought separately (but not in India, in German stock exchanges). Since the offshore wind farms are expected to see a 'boom', Repower alone also in my opinion is one of the best wind energy stocks available at the moment. This is given the fact that Repower margins are expected to improve because of the advantage of Suzlon's marketing network.

Suzlon Wind Energy stock - financials

- Suzlon's current Debt equity ratio is about 1.5.

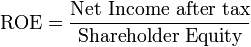

- ROE for the years 2005 to 2008 has been 38%, 29%, 28%, 20%. From 2008 to 2010 Suzlon has not had a profitable year.

- Exepected topline growth is about 20% in Wind industry, once the global economy recovers.

- EBITDA margins during 2005-2008 were about 8% to 10%. In 2008, and 2009, margins have dropped to less than 4% due to various reasons like lower volumes, recall of some of its problematic blades, etc.

Suzlon Wind Energy stock - Positives

- Suzulon's products are nearly 20%-25% cheaper than other leading wind turbine manufacturers. Since initial cost for setting up wind farms is quite significant, this is a great advantage.

- Suzlon is a vertically integrated company, and can leverage its network to increase sales of Repower products too.

- Suzlon held a 53% market share in India, a fast growing market for Wind turbines.

- Management of Suzlon has been very aggressive in expansion of the company. The company started with merely 3 employees in 1995 and went on to become the third largest in the industry by 2009.

- Several governments have and are likely to provide tax incentives to encourage clean energy options like Wind Energy.

Suzlon Wind Energy stock - Risks, Negatives.

- There is extremely high competition in the industry with several different players.

- Suzlons blades have been a major problem in the past with almost all blades supplied to the US developing cracks. These had to be replaced costing Suzlon over Rs. 2000 crore.

- Suzlon has serious debt problems. It has $500 million in zero coupon FCCB (foreign currency convertible bonds) due on June 2012 and Oct 2012. Suzlon has managed to bring down the floor price of this bond. However, if the company does not do well by June 2012, and these bonds do not get converted, then the company is in deep trouble in paying back the money. Moreover, even if all the FCCB get converted, there will be about 20% equity dilution.

- Any slowdown in China, US and Europe will impact sales.

Suzlon Wind Energy stock- summary

Concerns about the quality of its blades and high debt remain the main risk factors in investing Suzlon Wind Energy stock. However one should note that recalls and problems with products is something which has been experienced by other large companies, - remember the largest car company Toyota recalled more than 8 million vehicles worldwide?. That does not necessarily mean the company cannot overcome the problem. Moreover, at current valuations (1.6 times Book Value), Suzlon Wind energy stock is attractively priced and I think of this as the Best Stock available and makes a great investment opportunity. Recent Posts related to the theme "Best Stocks to Buy Now" (2010)

Stocks which were "Best Stocks to Invest" for year 2009, but now, the analysis may or may not apply, as prospects for the current year have changed.

|